Bull Call Spread Strategy

Options buying as we all know is a convenient way to trade bullish or bearish views. When the view is bullish, we can simply buy a Call Option. However, many of us have faced difficulty with buying options when we are trading with a 3-5 sessions (Short Term) view. This is because Options are a crucial element of Time Value Impact.

Especially when we buy an Option with a view to holding it for 3-5 trading sessions (short term). The negative Time Value Impact takes away a lot of the positive impact of our winning trade. This negative impact reduces the efficiency of short-term options trading by simply buying options.

Solution for making it efficient: Bull Call Spread

What is Bull Call Spread?

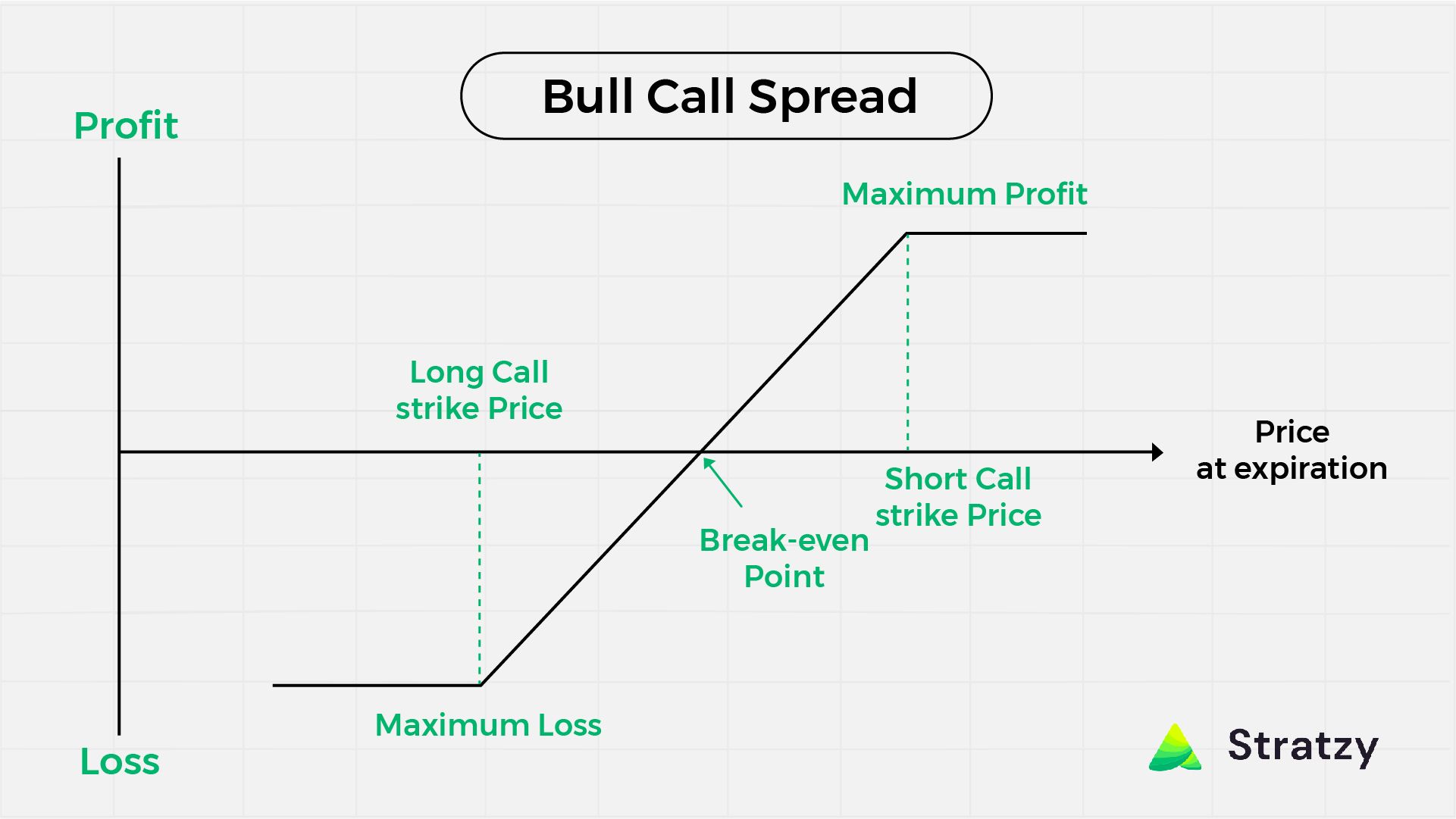

Bull Call Spread is a bullish options trading strategy executed by buying a call and selling a higher strike call to fund it. It is a strategy with limited risk and limited reward.

Bull Call Spread is much more efficient than simply buying a call because it reduces the negative impact of time value.

What is the logic behind Bull Call Spread Strategy?

The logic behind the bull call spread strategy is that the investor expects the stock price to rise but wants to limit potential losses in case the stock price goes down instead.

The Bull Call Spread strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price to benefit from a moderate bullish move in the underlying asset while limiting potential losses. By reducing the cost of buying the long call option with the premium received from selling the short call option, the strategy provides a limited risk-reward ratio for traders who want to benefit from a limited upside potential with limited downside risk.

What is Maximum profit?

Maximum profit is limited to the difference in buy and sell strike less net premium paid (Buy Option Premium – Sell Option Premium).

Maximum profit arises if the stock or index closes at or above the higher strike.

What is Maximum Loss?

The maximum risk is limited to the net premium paid.

The break-even for the strategy would be a lower strike plus net premium paid.

Since the Max Profit and Max Loss in this trade are capped. The trade chart looks similar to the one given below.

Which Strikes to Select for a Bull Call Spread Strategy?

A buy call can be a strike close to the current market price, and a sell call strike can be above the expected target in the short term.

Example:

Stock A is trading at Rs 1000. We are bullish on the stock with a short-term target of 1040. As a trader, we also have a stop loss of 980.

Available Strikes: 950, 985, 1000, 1025, 1050, 1075

Bull Call Spread:

Buy 1000 Call (Close to the Current Market Price)

Sell 1050 Call (Close to the expected target)

Important Points:

- Remember, we are trading only for 3-5 sessions, not the entire expiry. So, we may not achieve maximum profit if the stock goes up to 1050 during the expiry. At the same time, we might not have a maximum loss if the stock reaches our stop loss level during the expiry.

- Booking Profit in the position by Selling the Bought Call Option and Buying Back the Sold Call Option within the short term may not be equal to maximum profit but it would be much higher than the loss at 980. This makes it much more efficient.

- Unlike Buying a Call, the Bull Call Spread strategy requires a Margin to be given to the exchange. On the other hand, the Premium paid & maximum loss in Bull Call Spread is much lower than the Buy Call trade.

Thus, trade a bullish view in the short term efficiently with Bull Call Spread by reducing the negative Time Value impact.

Conclusion:

In case of a bullish view, you can also look for other bullish options strategies like Bull Put Ladder Strategy, Call Ratio Back Spread Strategy, etc. based on market conditions.

Also, similar to Bull Call Spread Strategy is the Bear Put Spread Strategy, in this instead of a bullish view the trader has a bearish view of the market.

There can be various Options Strategies but the one best for trading will depend on the trade set-up on that particular day and the view of the trader of what he/she expects in the market.

Learn Option series next reads: