Call Ratio Back Spread Strategy

The call ratio back spread strategy is a popular options trading strategy used by traders who are bullish on a particular stock or index. This strategy involves selling one out of the money call option and buying two or more further out of the money call options. This trading strategy is used when the trader expects a moderate rise in the price of the underlying asset, but wants to limit the downside risk.

Components of this Strategy

The call ratio back spread strategy is made up of the following components:

A long call option

This is an option that gives the holder the right to buy the underlying asset at a predetermined price, known as the strike price, at any time before the option expires. When you buy a long call option, you are betting that the price of the underlying security will rise above the strike price before the option expires.

A short call option

This is an option that gives the holder the obligation to sell the underlying asset at a predetermined price, known as the strike price, at any time before the option expires. When you sell a short call option, you are betting that the price of the underlying security will not rise above the strike price before the option expires.

The ratio

This strategy involves selling one out of the money call option and buying two or more further out of the money call options. The ratio is the number of call options sold to the number of call options bought. The call options are said to be out of the money when the strike price is above the current market price of the underlying asset.

The logic behind this Strategy

The call ratio back spread strategy is designed to take advantage of a small price increase in the underlying asset while limiting the downside risk if the price of the underlying asset falls. The trader expects a moderate rise in the price of the underlying asset but wants to limit the downside risk.

When the trader sells one out of the money call option, they receive a premium for the option. This premium can be used to buy two or more further out of the money call options. Since the trader is buying more options than they are selling, the strategy is known as a "back spread".

If the price of the underlying asset rises above the strike price of the sold call option, the trader will make a profit on the sold call option. At the same time, the trader will also make a profit on the bought call options. Since the trader is buying more options than they are selling, the profit on the bought call options will be greater than the loss on the sold call option.

If the price of the underlying asset falls below the strike price of the sold call option, the trader will lose money on the sold call option. At the same time, the trader will also lose money on the bought call options. However, the loss on the bought call options will be less than the loss on the sold call option.

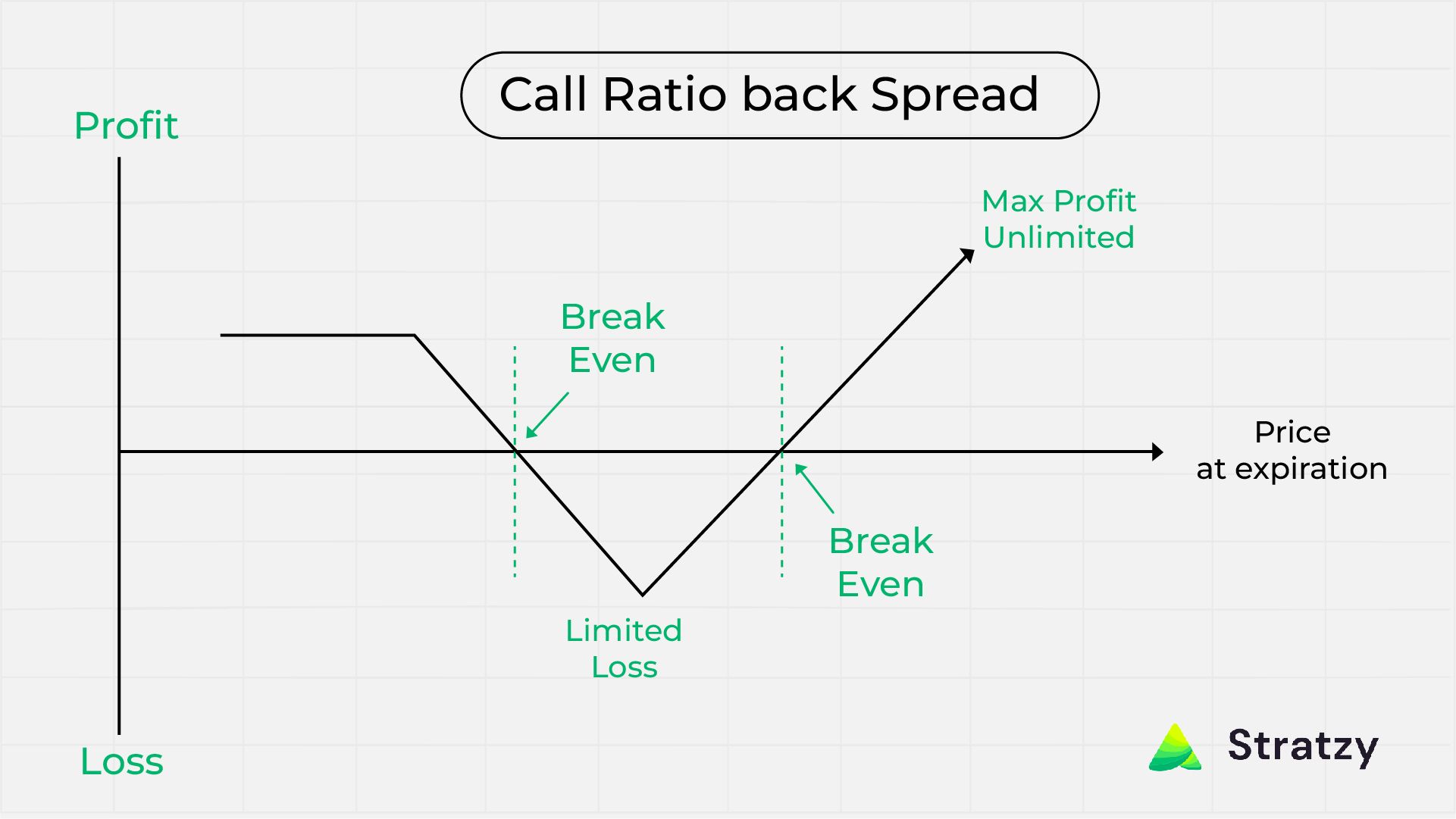

Max Profit and Loss under this Strategy

The maximum profit that can be made under this strategy is unlimited. This is because the trader benefits from the unlimited rise in the price of the underlying asset. If the price of the underlying asset rises above the strike price of the sold call option, the trader can make a profit on the sold call option, as well as on the bought call options.

The maximum loss that can be incurred under this strategy is limited to the net premium paid for the options. If the price of the underlying asset falls below the strike price of the sold call option, the trader can lose money on the sold call option, as well as on the bought call options. However, the loss on the bought call options will be less than the loss on the sold call option.

Payoff Matrix of this Strategy:

Example of call ratio back spread strategy

Let's assume that the current market price of XYZ stock is INR 100. The trader expects the price of the stock to rise moderately in the near future. The trader sells one out-of-the-money call option with a strike price of INR 110 for a premium of INR 5 and buys two further out-of-the-money call options with a strike price of INR 120 for a premium of INR 2 each. The ratio is 1:2.

If the price of the stock rises to INR 125, the trader will make a profit of INR 15 (INR 125 - INR 110) on the sold call option and a profit of INR 6 (INR 125 - INR 120) on the two bought call options. The total profit will be INR 21 (INR 15 + INR 6). If the price of the stock falls to INR 95, the trader will incur a loss of INR 5 (INR 100 - INR 95) on the sold call option and a loss of INR 4 (2 x INR 2) on the two bought call options. The total loss will be INR 9 (INR 5 + INR 4).

Pros and Cons of this Strategy

Pros

- The trader can benefit from a moderate rise in the price of the underlying asset.

- The trader can limit the downside risk.

- The maximum profit that can be made under this strategy is unlimited.

Cons

- The trader will incur a loss if the price of the underlying asset falls significantly.

- The trader may not benefit from a large rise in the price of the underlying asset.

- This strategy involves buying more options than selling, which can increase the cost of the trade.

Conclusion

The call ratio back spread strategy is a popular options trading strategy used by traders who are bullish on a particular stock or index. This strategy involves selling one out of the money call option and buying two or more further out of the money call options. The strategy is designed to take advantage of a small price increase in the underlying asset, while limiting the downside risk if the price of the underlying asset falls.

However, the trader may not benefit from a large rise in the price of the underlying asset and may incur a loss if the price of the underlying asset falls significantly. As with any trading strategy, it is important to understand the risks and benefits before implementing the call ratio back spread strategy. This strategy is best suited for traders who are looking to make a moderate profit while limiting their downside risk. It is important to have a clear understanding of the market conditions and the underlying asset before implementing this strategy.

Learn Option series next reads: