Option Trading Strategies

Options trading can be a complex and exciting way to invest in the financial markets. With options, traders have the flexibility to take advantage of a variety of market conditions and tailor their trading strategies to their individual needs and risk tolerance.

There are many different strategies but you only need to know a handful of strategies really well. Once you know these strategies all you need to do is analyze the current state of markets (or the stock) and map it with the right option strategy from your strategy quiver.

In this article, we'll take a comprehensive look at the most widely used options trading strategies and how they work.

Long Call

The long call strategy is one of the simplest and most popular option trading strategies. It involves buying a call option expecting the underlying asset's price to increase above the strike price before the option's expiration date. The buyer of the call option has the right but not the obligation to purchase the underlying asset at the strike price.

This strategy offers unlimited profit potential, but limited risk, as the maximum loss is limited to the premium paid for the option. The long call strategy is best suited for bullish market conditions and works best when volatility is low.

Long Put

The long-put strategy is the opposite of the long-call strategy. It involves buying a put option expecting the underlying asset's price to decrease below the strike price before the option's expiration date. The buyer of the put option has the right but not the obligation to sell the underlying asset at the strike price.

This strategy also offers unlimited profit potential and limited risk, as the maximum loss is limited to the premium paid for the option. The long put strategy is best suited for bearish market conditions and works best when volatility is low.

Covered Call

The covered call option strategy is a popular income-generating strategy that involves holding a long position in an asset and selling call options on that same asset. The seller of the call option receives a premium and agrees to sell the underlying asset at the strike price if the option is exercised.

This strategy offers limited profit potential and limited risk, as the maximum profit is limited to the premium received for selling the call option, and the maximum loss is limited to the difference between the purchase price of the asset and the strike price of the call option. The covered call strategy is best suited for neutral or slightly bullish market conditions and can be an effective way to generate income from a long-term holding.

Protective Put

The protective put option strategy, also known as the married put strategy, involves buying a put option on an asset that you already own to protect against a potential decrease in the asset's price. The buyer of the put option has the right but not the obligation to sell the underlying asset at the strike price.

This strategy offers limited profit potential and limited risk, as the maximum loss is limited to the premium paid for the put option. The protective put strategy is best suited for investors who are bullish on the asset's long-term prospects but want to protect against short-term volatility.

Straddle

The straddle strategy is a popular options trading strategy that involves buying both a call option and a put option on the same asset with the same expiration date and strike price. This strategy is best suited for traders who expect significant price movements in either direction but are unsure of the direction.

The straddle strategy offers unlimited profit potential and limited risk, as the maximum loss is limited to the total premium paid for both the call and put options. The straddle strategy works best when volatility is high and can be an effective way to take advantage of significant price movements in either direction.

Strangle

The strangle strategy is similar to the straddle strategy but involves buying both a call option and a put option on the same asset with different strike prices. The call option is purchased at a higher strike price than the put option, and the options have the same expiration date.

The strangle strategy offers unlimited profit potential and limited risk, as the maximum loss is limited to the total premium paid for both the call and put options. The strangle strategy is best suited for traders who expect significant price movements in either direction but are unsure of the direction.

Iron Butterfly

The iron butterfly strategy is a neutral options trading strategy that involves buying and selling four different options with the same expiration date but different strike prices. It involves selling both a call option and a put option at the middle strike price and buying a call option at a higher strike price and a put option at a lower strike price.

This strategy offers limited profit potential and limited risk, as the maximum profit is achieved when the underlying asset's price is at the middle strike price at expiration, and the maximum loss is limited to the premium paid for the options. The iron butterfly strategy works best when volatility is low.

Iron Condor

The iron condor is a popular options trading strategy that involves buying and selling four different options with the same expiration date but different strike prices. It involves selling both a call option and a put option at a higher strike price and buying a call option at an even higher strike price and a put option at an even lower strike price.

This strategy offers limited profit potential and limited risk, as the maximum profit is achieved when the underlying asset's price remains within the strike prices of the sold call and put options, and the maximum loss is limited to the premium paid for the options. The iron condor strategy works best when volatility is low and the underlying asset's price is expected to remain relatively stable.

Calendar Spread

The calendar spread, also known as the time spread, involves buying and selling two options with the same strike price but different expiration dates. The goal of this strategy is to take advantage of the time decay of options by selling the short-term option and buying the longer-term option.

This strategy offers limited profit potential and limited risk, as the maximum profit is achieved when the underlying asset's price is at the strike price at the expiration of the short-term option, and the maximum loss is limited to the premium paid for the options. The calendar spread strategy works best when volatility is low, and the underlying asset's price is expected to remain relatively stable.

Bull Call Spread

The bull call spread is a bullish options trading strategy that involves buying a call option at a lower strike price and selling a call option at a higher strike price with the same expiration date. The goal of this strategy is to take advantage of a bullish market by limiting the potential loss and lowering the cost of buying the call option.

This strategy offers limited profit potential and limited risk, as the maximum profit is achieved when the underlying asset's price is at or above the higher strike price at expiration, and the maximum loss is limited to the premium paid for the options. The bull call spread strategy works best when volatility is low.

Bear Put Spread

The bear put spread is a bearish options trading strategy that involves buying a put option at a higher strike price and selling a put option at a lower strike price with the same expiration date. The goal of this strategy is to take advantage of a bearish market by limiting the potential loss and lowering the cost of buying the put option.

This strategy offers limited profit potential and limited risk, as the maximum profit is achieved when the underlying asset's price is at or below the lower strike price at expiration, and the maximum loss is limited to the premium paid for the options. The bear put spread strategy works best when volatility is low.

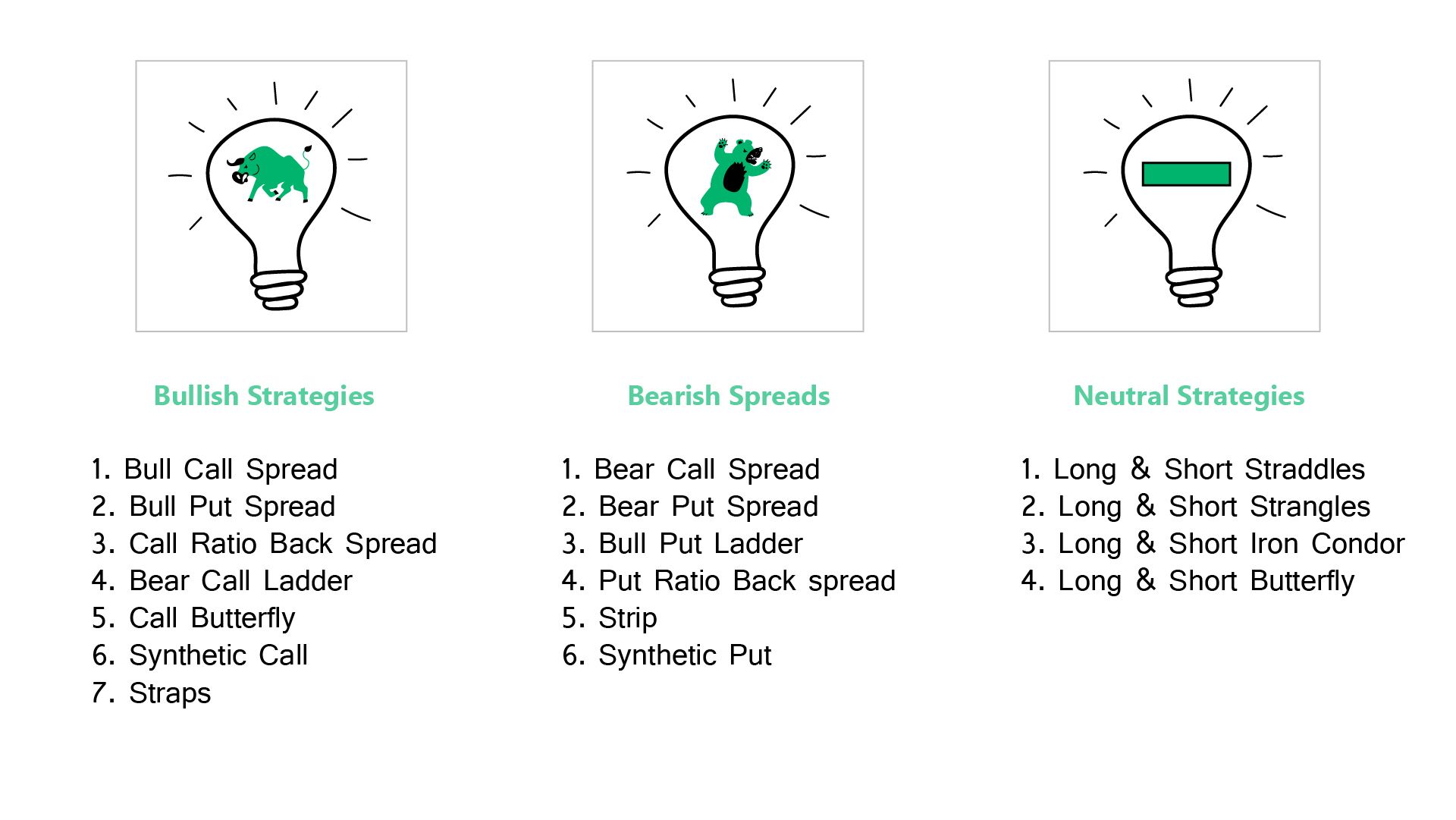

Apart from the above-mentioned Strategies you can also learn about the following strategies for better decision-making in the stock market.

1. Long & Short Butterfly Strategy

2. Synthetic Put Strategy

3. Strip Strategy

4. Bear call Spread Strategy

5. Put Ratio Back Spread Strategy

6. Synthetic Call Strategy

and so on and so on.....

Conclusion

Options trading offers a wide variety of strategies for traders to take advantage of different market conditions and tailor their trades to their individual needs and risk tolerance. Each strategy has its own unique characteristics, advantages, and disadvantages. It's essential to do your research, understand the risks and rewards of each strategy, and have a solid understanding of options trading before implementing any strategy. With proper risk management and a well-thought-out trading plan, options trading can be a powerful tool for generating profits and managing risk.

Learn Option series next reads: