Rebalancing Process

Hey 🙋

Glad to see you again. Also happy to see your journey towards a smart investor.

Becoming a smart investor is not easy unless you have stratzy by your side. The market winners need to keep a regular watch over their portfolio and keep shuffling the stocks. This requires hours of dedicated study of the Economy, Stock Market, Industry and the company😨

Don’t worry, you don’t need to do all these, the investment team at Stratzy does all these research and provide you with the best Analysis and recommendations to switch to from the existing portfolio to keep the growth momentum continued for your wealth creation process. This process or switching your stocks with some other stocks for continued growth or mitigate losses is known as Strategy Rebalancing.

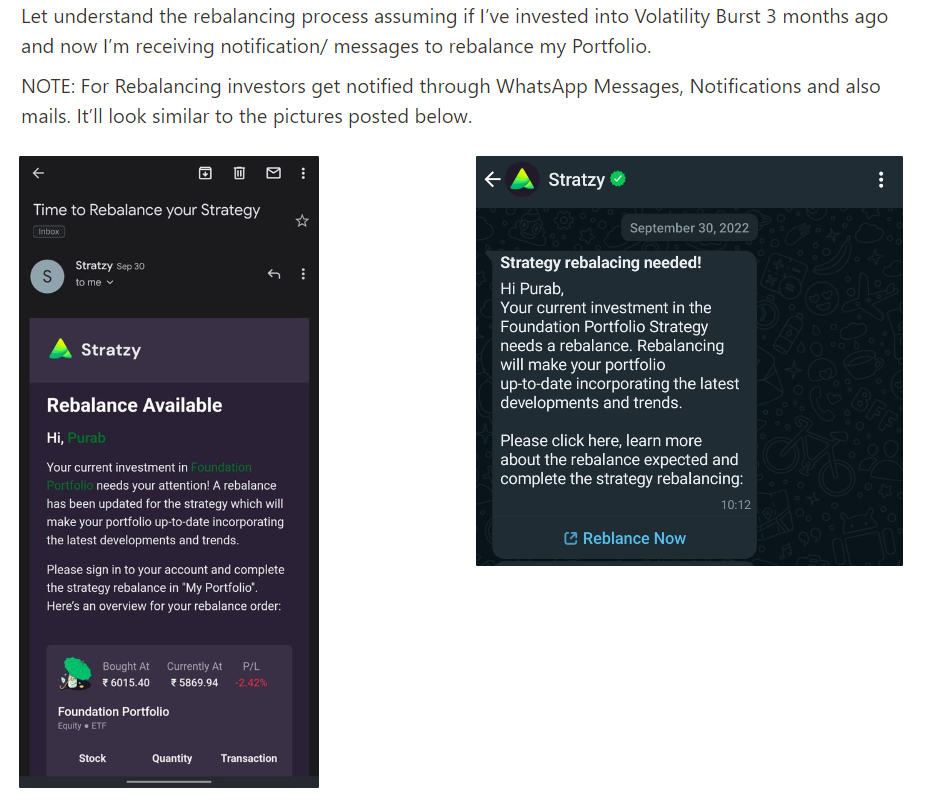

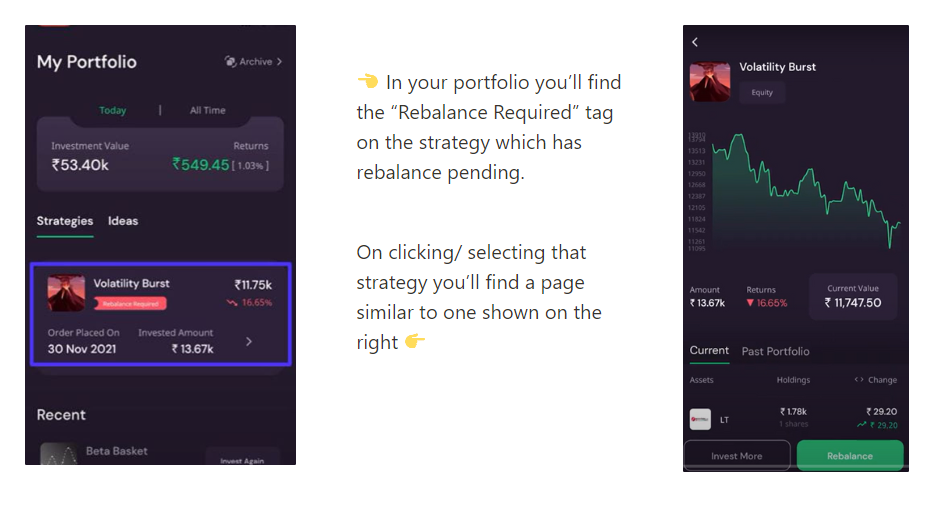

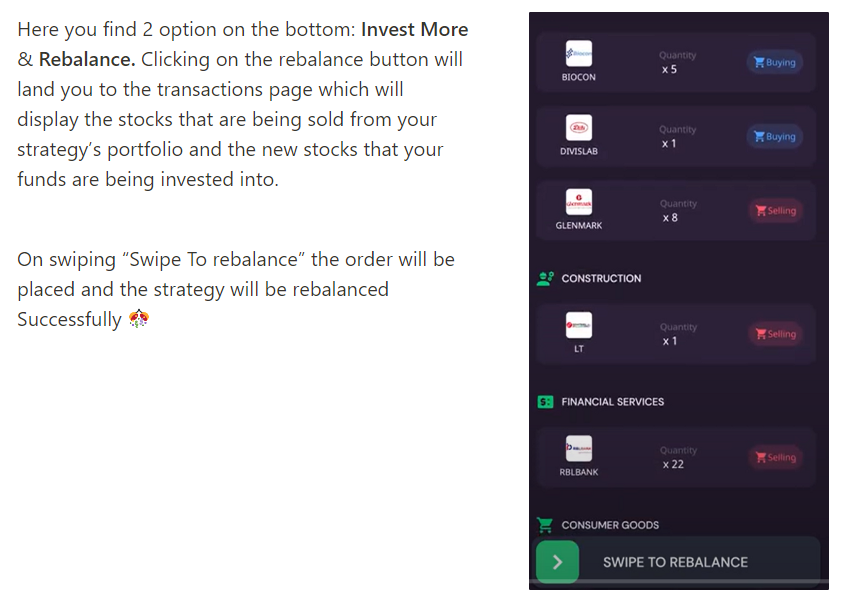

On clicking on “Rebalance Now” from Mail or WhatsApp message you’ll land to Stratzy portfolio page where you’ll be able to see the strategy that requires rebalancing.

🗒️ Things to Note for rebalancing

- The amount invested into new stock is approximately same to the value of stocks that are being sold.

- Since, when you sell a stock only 80% money is credited on that day and the rest 20% on the next day. So, a users needs to maintain some extra funds to execute the rebalancing process. Lets understand this with an example: Suppose the stocks that are being removed has a market value of Rs. 3000, and the new stocks to invest also has a value of Rs. 3000. So, when you sell the stock only 80% is credited on that day i.e. Rs. 2400 and the rest Rs. 600 will be credited next day, but for investing into new stocks you need Rs. 3000 at present in your wallet else the buy order will not execute. Thus, to avoid this, its recommended to have some extra funds during the time of rebalancing.

- Rebalancing is not compulsory but it is recommended to execute all the rebalancing to avoid any losses and have continued growth in the portfolio.