Rho: The Options Greek

Options trading can be complicated, and there are a lot of factors that can impact the value of an option. One of these factors is known as rho, which is one of the "Greeks" used to measure the sensitivity of an option's price to various market conditions. In this blog post, we will explore what rho is, how it works, and how it can be used by options traders.

What is Rho?

Rho (ρ) is one of the Greeks used to measure an option’s price sensitivity to changes in interest rates. Specifically, rho measures the change in the price of an option for every 1% change in interest rates. Rho is expressed as a decimal, and it can be positive or negative, depending on the type of option and the prevailing interest rates.

How Rho Works

Rho is based on the idea that as interest rates rise, the value of money also rises. This means that an investor who lends money will demand a higher rate of interest to compensate for the increased value of their money. This has an impact on the price of options because options involve borrowing money to purchase the underlying asset.

Rho is used to measure the impact of changes in interest rates on the price of the option. If interest rates rise by 1%, the price of the option will change by the value of rho. If rho is positive, the price of the option will increase as interest rates rise, and if rho is negative, the price of the option will decrease as interest rates rise.

How is Rho Calculated?

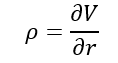

The formula for calculating rho is relatively simple. It is calculated as the change in the price of an option divided by the change in interest rates, multiplied by 100. The formula is as follows:

Where:

- ∂ – the first derivative

- V – the option’s price (theoretical value)

- r – interest rate

For example, if the price of a call option on a stock increased by Rs. 5 when interest rates increased by 1%, the rho for that option would be:

Rho = (5 / 1) x 100 = 500

This means that the price of the option would increase by Rs. 500 if interest rates were to increase by 1%.

In our example, let's say you are considering purchasing a call option on a stock with a strike price of Rs. 1,000. If interest rates are low, you may be able to borrow the money you need to purchase the option at a low-interest rate, say 6%. However, if interest rates rise to 7%, the cost of borrowing the money will increase, which will make the option more expensive.

If the rho for the option is 0.04, this means that the price of the option would increase by Rs. 40 if interest rates were to increase by 1%. So, if interest rates increase from 6% to 7%, the price of the option would increase by:

Price increase = Rho x Interest Rate Change x Strike Price Price increase

= 0.04 x 1 x 1,000

Price increase = Rs. 40

Therefore, if you were considering purchasing the option and you expected interest rates to increase, you may want to wait before making your purchase to see if you can get a better price. Conversely, if you were considering selling the option and you expected interest rates to increase, you may want to sell the option before interest rates rise to maximize your profits.

Using Rho in Options Trading

Rho is an important factor to consider when trading options because changes in interest rates can have a significant impact on the price of an option. This means that options traders need to be aware of changes in interest rates and how they will affect the price of their options.

For example, if you are considering purchasing a call option on a stock and you expect interest rates to rise, you may want to wait before making your purchase. This is because the price of the option may increase as interest rates rise, which means that you may be able to purchase the option at a lower price if you wait.

On the other hand, if you are considering selling a call option on a stock and you expect interest rates to rise, you may want to sell the option before interest rates rise. This is because the price of the option may decrease as interest rates rise, which means that you may be able to sell the option at a higher price if you act quickly.

Conclusion

Rho is an important Greek used in options trading that measures the sensitivity of an option's price to changes in interest rates. Rho can be positive or negative, depending on the type of option and the prevailing interest rates. Options traders need to be aware of changes in interest rates and how they will affect the price of their options. By understanding rho, traders can make more informed decisions about when to buy or sell options based on changes in interest rates.

Learn Option series next reads: